If you’re a small business owner, you already know how important health benefits are—not just for attracting great employees, but for keeping the ones you’ve already got. But let’s face it: traditional employer sponsored health insurance can be expensive, rigid, and overwhelming to manage.

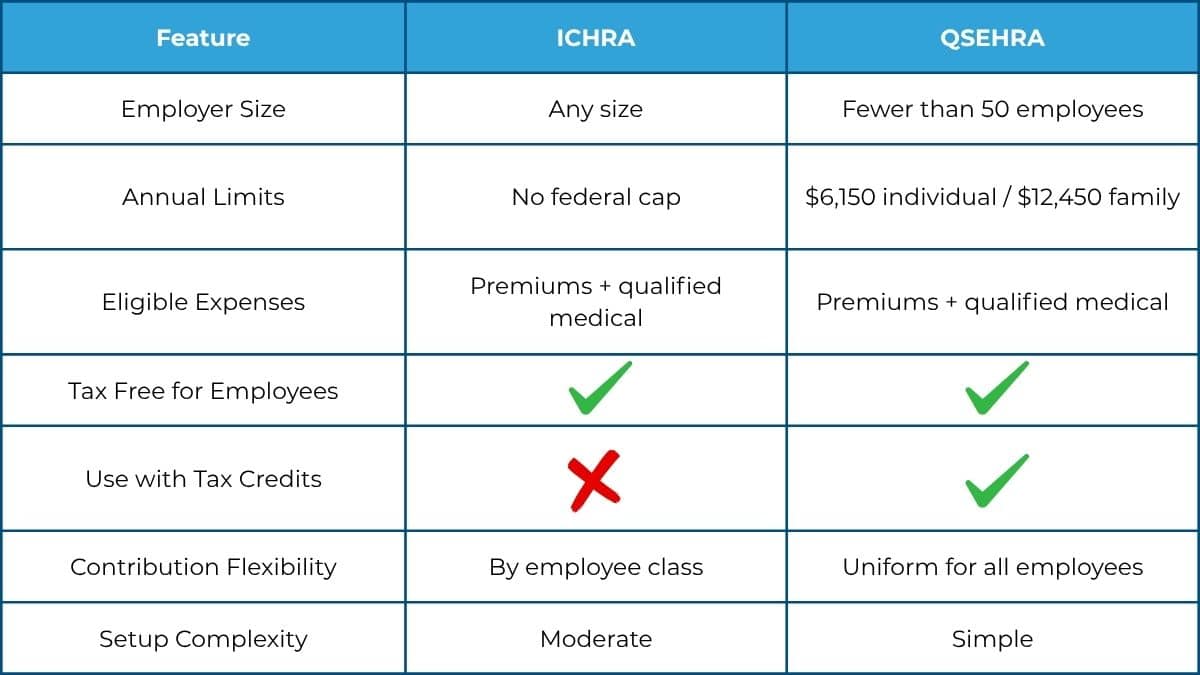

Fortunately, there are newer, flexible alternatives designed with small businesses in mind: ICHRA (Individual Coverage Health Reimbursement Arrangement) and QSEHRA (Qualified Small Employer HRA). Both options allow you to reimburse employees tax-free for their individual health insurance premiums—but they work in very different ways.

In this post, we’ll break down how ICHRA vs QSEHRA for small business health insurance compare, which is best for different types of businesses, and what’s changing in 2025.

What Is an ICHRA?

The Individual Coverage HRA was introduced in 2020 as part of a federal push to make health insurance more flexible for employers and employees alike. With an ICHRA, you offer employees a set monthly allowance that they can use to purchase their own health insurance on the individual market.

Want a deeper dive into ICHRAs? Check out our guide: What is an ICHRA and How Does it Work?

Key ICHRA Features:

- Available to employers of any size

- No set contribution limits

- Must be used with qualified individual health insurance

- Can vary contributions by class of employee (full-time, part-time, etc.)

- Employees can’t use premium tax credits if they accept ICHRA funds

ICHRA adoption is growing rapidly. In fact, according to the HRA Council, the number of employees offered ICHRA plans more than doubled between 2022 and 2023, with over 600,000 participants projected by the end of 2025.

What Is a QSEHRA?

A Qualified Small Employer Health Reimbursement Arrangement is similar in concept but specifically designed for companies with fewer than 50 full-time employees. It also allows you to reimburse employees for their individual health insurance premiums and qualified medical expenses, tax-free.

Key QSEHRA Features:

- Only for small businesses with fewer than 50 full-time employees

- Annual reimbursement limits for 2025:

- $6,150 for individuals

- $12,450 for families (Investopedia)

- Employees can still qualify for premium tax credits (if QSEHRA is considered unaffordable)

Which Is Better: ICHRA or QSEHRA for Small Business Health Insurance?

Choosing between ICHRA and QSEHRA depends on your company size, goals, and budget.

Choose ICHRA if:

- You have 50+ employees or plan to scale soon

- You want full control over contribution limits

- You need flexibility to offer different benefits to different employee classes

- You don’t want to deal with group plan administration

Already considering switching to ICHRA? See how an ICHRA can lower your benefit costs during uncertain times.

Choose QSEHRA if:

- You have fewer than 50 employees

- You’re looking for a low-maintenance, affordable way to offer benefits

- You want employees to retain access to premium tax credits

- You don’t need to customize reimbursement levels by employee group

Why Small Businesses Are Making the Switch in 2025

With health insurance premiums continuing to rise and talent competition heating up, more small businesses are ditching traditional group medical insurance and small group health insurance in favor of reimbursement-based options. These approaches not only reduce financial risk but also empower employees to choose plans that actually work for them.

Curious what else is changing? Don’t miss our Top 5 Group Health Insurance Trends in 2025.

Plus, many small employers are realizing they don’t need to shoulder the full cost of a group plan to stay competitive—just offering something flexible and tax-efficient can go a long way.

Final Thoughts: Keep Benefits Simple, Smart, and Strategic

As a small business owner, your time and resources are valuable. If traditional group health insurance feels like more than your team needs—or your budget allows—ICHRA vs QSEHRA for small business health insurance presents two proven ways to offer real value without the overhead.

Want to explore even more flexible strategies? Here are 8 simple ways to reduce your group insurance costs.

Ready to find the right health benefits solution for your small business?

Our licensed agents can walk you through what works best for your company—and help you start offering benefits your employees will actually use.